We’re excited to announce a very anticipated and requested change – equity based drawdown.

As you might know, the drawdown calculation up until now was balance based, however that isn’t the most accurate way of measuring drawdown since equity can move drastically while the balance remains the same, hence the requested change.

Along with this change, custom analysis will now calculate the true equity based drawdown, in real time (based on your analysis settings).

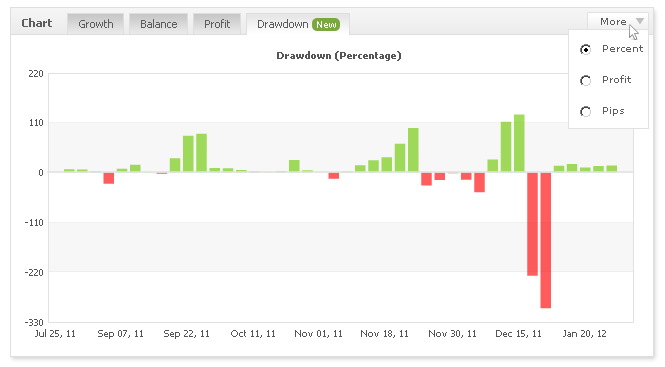

Also, not only we’ve changed the drawdown calculation method, but we’ve also added drawdown history which you can notice in a new chart in your system page called “drawdown” – you can now see daily drawdown based on percentage, profit, or pips! These are invaluable metrics in assessing a system’s risk:

As a side note, you’ll notice a a lot less systems in the systems section since many of the systems got filtered out due to the calculation method change (default drawdown setting is 30%).

All accounts are being reprocessed for the new metrics and should complete within an hour.

Have a great week,

The Myfxbook team.

great.

the “systems section” is getting much more useful day by day.

just last notice. the “systems section” should include older systems. there are too many “young and crazy” systems in it.

your “systems section” is the most important page and it relies a lot on default settings.

admitting in it systems as old as 1 doesn’t make it like a hall of honor.

my point of view is that it should include systems at least 3 months old.

Thank you for your feedback! 🙂

further improvements of default settings should include, following my point of view:

– default sorting based upon monthly average (average calculated on monthly results basis) -> this leads to enhance positions of systems that are more constant in results, instead of systems that have few bursts

– public equity, balance and lots (traded and current) -> this is a “social” website, so sharing should be prized

This site and services did a MAJOR jumpt to the heavy weight series now!

This is PRO level stuff now!

By calculating the REAL DD in realtime (not only at the end of the position) the public/users can REALLY know how risky the system really is!