Before opening a position in your Forex Trading account, calculating the correct lot size or position size may not be a simple task, especially when you’re in a hurry to open a position.

When calculating the position size, you need to take into account multiple factors:

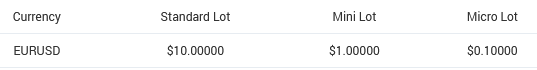

- trade sizing with your broker which may be a standard lots (100,000 units), mini lots (10,000 units) or micro lots (1,000 units). The trade size will affect the pip value, for example:

- the risk percentage (or alternatively the dollar amount) you can afford to lose in case the trade goes against you and hits your stop loss

- the stop loss according to your risk appetite

Using the above inputs along with your account balance and deposit currency can be easily calculated for the different account currencies.

Most importantly, this calculation changes for each currency pair you trade and therefore it is best to use our forex position size calculator and risk calculator.

Keep in mind that risk is one of the most important factors – Forex is high risk and therefore you shouldn’t risk more than 5% per trade. Remember that at 10% risk per trade it takes only 10 losing trades to wipe out your account! If you’re not sure how many pips you should set for the stop-loss, head over to our pip calculator.

Our calculator covers many foreign exchange pairs: