We’re excited to announce the addition of a new section called forex correlation. Before going over the section and its unique features, a quick explanation about why correlation is important for your trading.

Correlation tells you how two currencies move in relation to each other. Currencies can have a positive correlation (meaning they move in the same direction) and a negative correlation (meaning they move in opposite directions). Why should you care? If you’re trading 2 currency pairs which have a very high positive correlation, you’re effectively increasing your risk as if one position goes against you, so will the other one, based on their correlation. On the other hand, if you trade two currencies which have a high negative correlation, you are unlikely to have both positions profitable at the same time, due to the negative correlation. This is why you should be aware of correlations which can in turn reduce risk and improve your returns.

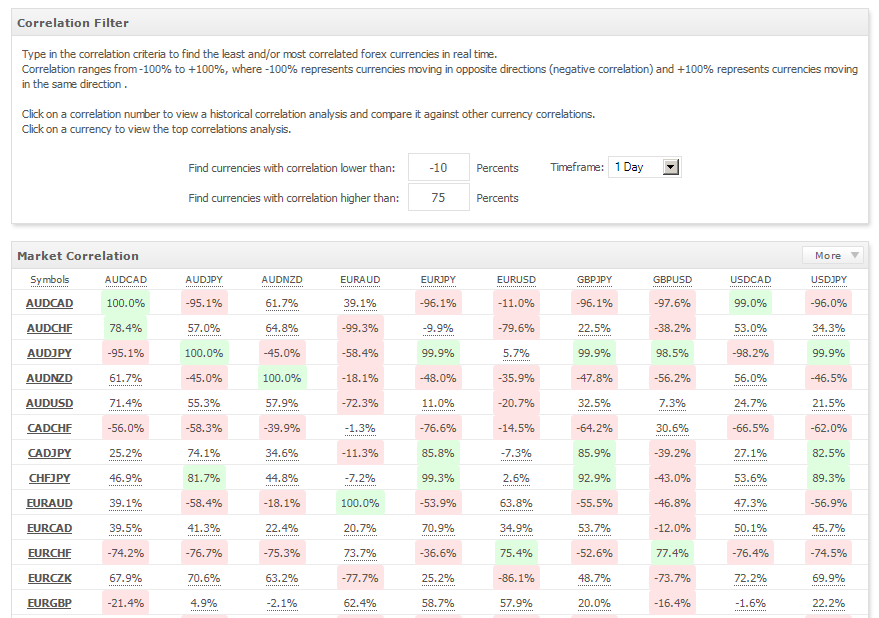

Moving on to the new section – the first page covers all of the correlations you would like to know of in one quick glance:

You can filter correlations in real-time based on min/max values.

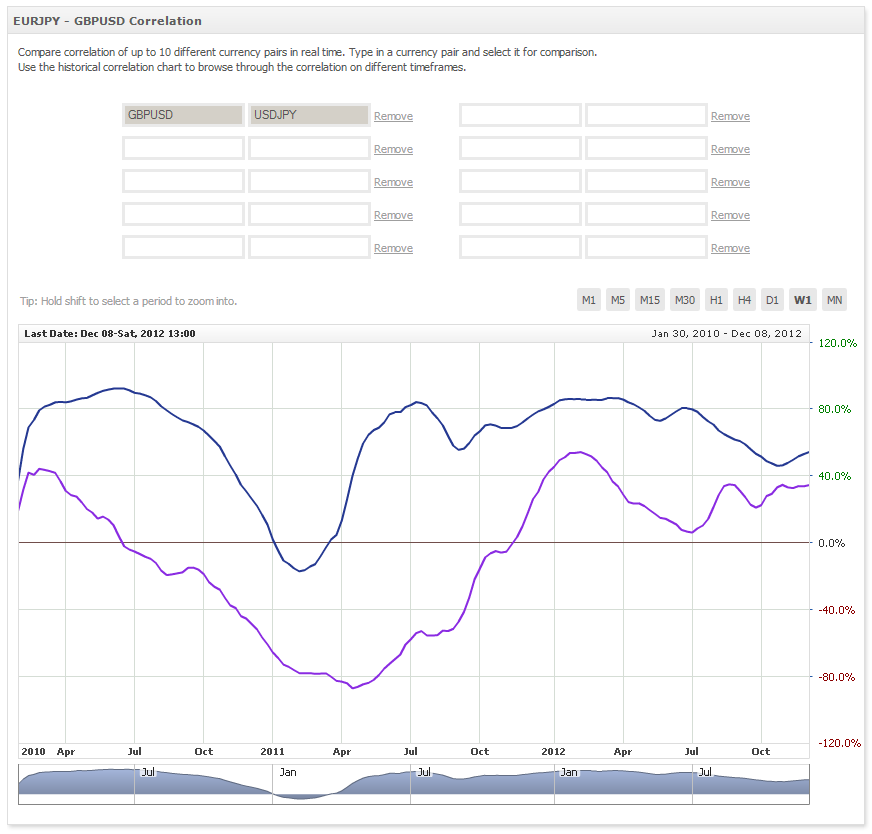

Clicking on a correlation result will get you to a historic correlation chart where you can compare up to 10 more correlations side by side:

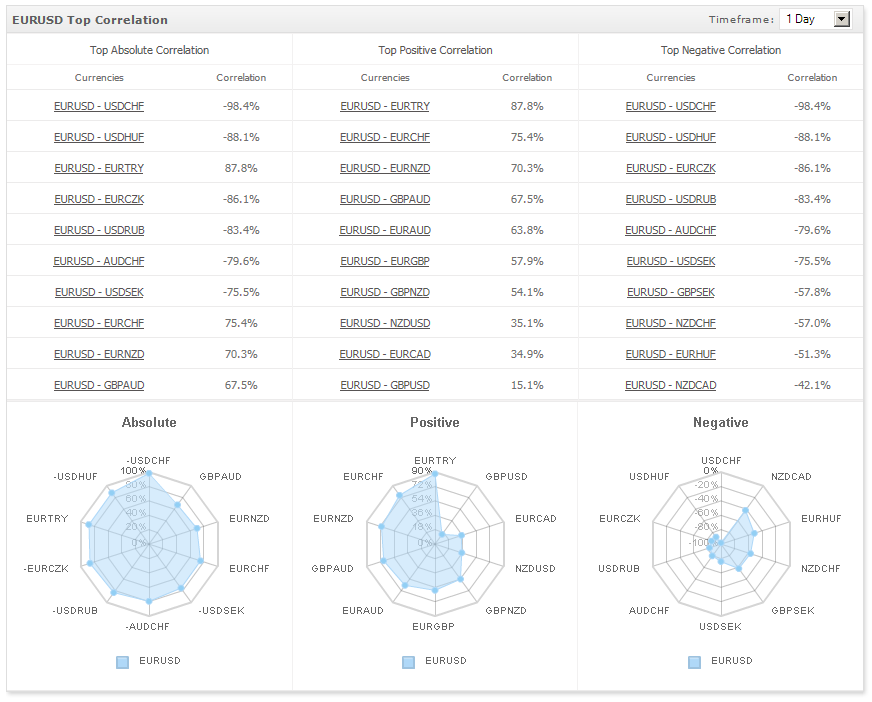

Clicking on a currency will reveal the top positive correlated currencies, top negative correlated currencies and top correlated currencies (absolute value) along with radar charts to help illustrate the correlation:

Have fun exploring the new section and do let us know of any feedback you may have.

Have a great week,

The Myfxbook team.